In today’s rapidly evolving financial landscape, obtaining the proper licensing is crucial for businesses that deal with money services. One of the most essential regulatory requirements in this industry is the MSB License, or Money Services Business License. Whether you’re operating a cryptocurrency exchange, remittance service, or currency exchange, understanding the MSB license is vital to stay compliant and build trust with your customers.

What is an MSB License?

An MSB License is a regulatory authorization issued to businesses involved in certain financial services. These include:

-

Money transmission

-

Foreign exchange dealing

-

Issuing or selling traveler’s checks, money orders, or prepaid cards

-

Check cashing

-

Dealing in virtual currencies like Bitcoin and other cryptocurrencies

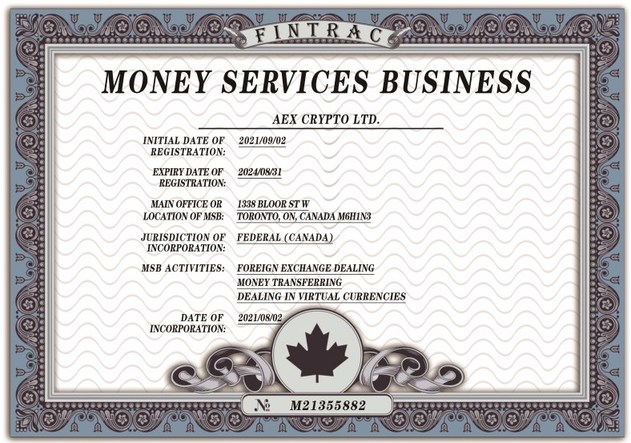

In the United States, MSBs must register with the Financial Crimes Enforcement Network (FinCEN). In Canada, they register with FINTRAC. Each country has its own governing body and compliance requirements.

Who Needs an MSB License?

If your business performs any of the following services, you’re likely required to apply for an MSB License:

-

Crypto Exchanges: If you’re offering cryptocurrency trading or wallets.

-

Remittance Companies: Sending or receiving funds across borders.

-

Forex Businesses: Buying or selling foreign currencies.

-

Prepaid Card Issuers: Including digital wallets and gift cards.

Failure to obtain proper licensing can lead to fines, account closures, or even criminal charges in some jurisdictions.

Why is the MSB License Important?

-

Legal Compliance: Avoid regulatory issues and potential penalties.

-

Credibility: Builds trust with banks, partners, and customers.

-

Global Access: Enables businesses to legally operate in multiple jurisdictions.

-

Banking Access: Easier access to business bank accounts and payment processors.

How to Apply for an MSB License?

The application process can be complicated and time-consuming, but with professional assistance, it becomes much more manageable. At Nilab Consultants, we offer complete assistance with:

-

MSB License Registration (USA, Canada, UAE, etc.)

-

AML/Compliance Program Setup

-

KYC and Risk Assessment Guidance

-

Ongoing Regulatory Reporting and Maintenance

Benefits of Working with Nilab Consultants

At Nilab Consultants, we simplify the process of regulatory compliance for your financial service business. Whether you’re starting a crypto company, forex business, or expanding your global payment services, we provide:

-

Expert consultation on MSB licensing and regulatory frameworks

-

Customized AML policies and procedures

-

Fast-track license approvals

-

Global service coverage, including Canada, UAE, USA, and more

Need Help with Your MSB License? Contact us today to get a free consultation!

Ready to Get Your MSB License?

Navigating licensing regulations can be complex, but you don’t have to do it alone. With our deep expertise in financial compliance and global licensing frameworks, Nilab Consultants is your trusted partner in starting or scaling your money services business. Visit our homepage to learn more about how we can help you succeed in your financial services venture.